ReferralTrader

ReferralTrader

Top 25 Trading Brokers/Exchanges of 2025

Get discounts on trading fees and bunuses for leading brokers Our referral website gathered list of Top 25 Trading brokers

ReferralTrader

Earn2Trade

A futures-focused prop trading firm offering evaluation programs to fund skilled traders with up to $400,000 in capital.

Earn2Trade provides a unique pathway for futures traders through its Trader Career Path® and Gauntlet Mini™ programs. Traders start with virtual accounts ranging from $25,000 to $200,000, proving their skills over a minimum of 10-15 trading days to meet profit targets and strict risk management rules.

Upon passing, traders receive a funded account from a partner proprietary firm, with the potential to scale up to $400,000 and keep 80% of profits. With robust educational resources and platforms like NinjaTrader, Earn2Trade is ideal for disciplined traders seeking a professional trading career.

Eightcap Partners

Multiple account types, advanced trading platform, and fast execution speeds for active traders.

Eightcap focuses on tight spreads, flexible leverage options, and lightning-fast order execution. Their advanced platform provides real-time charting tools and educational resources, making it easy for traders to analyze the market and develop their strategies.

With user-friendly web and mobile platforms, traders can monitor positions anytime and anywhere. Eightcap also offers a dedicated customer support team to assist with technical inquiries and account-related questions, ensuring a smooth trading experience for both beginners and professionals.

Vantage

Comprehensive asset coverage, modern trading environment, and enhanced charting tools for traders of all levels.

Vantage provides a state-of-the-art trading infrastructure with support for various instruments, including Forex, commodities, and indices. Their platform includes robust risk management features such as stop-loss and take-profit orders, along with in-depth market analysis for informed decision-making.

From live webinars to daily market insights, Vantage equips traders with valuable information to stay ahead in volatile markets. Their intuitive mobile app ensures convenience for those who want to trade on the go, while 24/7 customer support caters to global traders seeking prompt assistance.

AvaTrade

Intuitive platform design, multiple trading instruments, and powerful risk management tools.

AvaTrade stands out for its streamlined interface and support for various asset classes, including cryptocurrencies and commodities. The platform offers negative balance protection, ensuring traders never lose more than their account balance.

Beginner-friendly tutorials, free demo accounts, and robust charting packages make AvaTrade an excellent option for those looking to grow their skills. The broker also provides 24/5 multilingual customer support and advanced automation options for algorithmic trading.

eToro

Renowned social trading platform with copy trading features and a thriving trading community.

eToro revolutionized online trading with its intuitive interface and social trading network, allowing users to follow and copy successful traders. The platform supports various markets, including Forex, crypto, stocks, and more, with a user-friendly dashboard and interactive community features.

Users can take advantage of eToro’s built-in news feed and analyst insights to stay updated on market changes. Its mobile app allows for seamless position tracking and social interaction, making trading both accessible and collaborative for beginners and experts alike.

Pepperstone

Institutional-grade liquidity, transparent pricing, and flexible platform integrations.

Pepperstone is celebrated for its low-latency execution and range of trading platforms like MetaTrader and cTrader. Offering ECN-style spreads and advanced charting tools, it’s designed for traders seeking precision and speed.

The broker also provides negative balance protection, ensuring traders are shielded from extreme market volatility. With 24/5 multilingual support, Pepperstone accommodates a diverse global client base and offers extensive educational materials for all experience levels.

BlackBull

ECN trading environment, competitive spreads, and dedicated client support for a smooth trading experience.

BlackBull Markets delivers deep liquidity, lightning-fast execution, and a choice of account types tailored to varying trading styles. It offers advanced analytics, social trading features, and integration with popular platforms like MetaTrader.

The broker also prides itself on reliable customer service and transparent trading conditions, ensuring users can focus on developing profitable strategies. From new traders to seasoned pros, BlackBull’s suite of resources and daily market analysis aims to empower successful trading.

BlackBull

FxPro

Wide range of tradable instruments, advanced analytics, and a refined user experience for pros and novices alike.

FxPro is known for its competitive spreads and multiple execution models, catering to scalpers, day traders, and long-term investors. The platform offers negative balance protection and supports diverse trading strategies, from manual techniques to fully automated solutions.

With an intuitive web-based interface and powerful mobile apps, FxPro ensures seamless access to global markets. The broker also provides a rich library of tutorials, webinars, and market-analysis tools, making it easy to stay informed and hone your trading edge.

RoboForex

Multiple account types, high leverage options, and specialized auto-trading solutions for algorithmic enthusiasts.

RoboForex caters to traders seeking flexible leverage up to 1:2000, along with a variety of platforms including MT4, MT5, and cTrader. Its ecosystem supports copy trading, automated strategies, and robust charting features for in-depth technical analysis.

The broker also offers bonus programs, educational materials, and 24/7 multilingual support to accommodate users from diverse regions. Whether you’re a newcomer learning the ropes or an expert building custom EAs, RoboForex provides a stable and versatile environment for all.

Admiral Markets

Comprehensive suite of trading products, integrated market analysis, and a strong focus on trader education.

Admiral Markets stands out for its wide variety of instruments beyond Forex, including CFDs on stocks, ETFs, and commodities. Traders can benefit from competitive spreads, fast order execution, and powerful tools like MetaTrader Supreme Edition.

The broker’s advanced analytics and market commentary equip users with insights to make informed decisions. Admiral Markets also prioritizes trader education through webinars, tutorials, and in-depth guides, ensuring both novices and experienced traders have the resources needed to succeed.

easyMarkets

Innovative trading tools, fixed spreads, and risk management features designed for simplicity and control.

easyMarkets offers a unique trading experience with features like dealCancellation, Freeze Rate, and negative balance protection. Traders can access Forex, cryptocurrencies, and CFDs on commodities and indices through MT4, MT5, or their intuitive proprietary platform.

With fixed spreads, no slippage, and a strong focus on trader education through webinars and tutorials, easyMarkets caters to both beginners and experienced traders. Their 24/5 support ensures assistance whenever markets are open.

Binance

World-leading crypto exchange with extensive coin offerings and advanced trading features for all levels.

Binance is the largest cryptocurrency exchange by trading volume, offering hundreds of coins and tokens, from Bitcoin and Ethereum to emerging altcoins. Its platform includes spot trading, futures, staking, and a user-friendly interface with low fees starting at 0.1%.

With advanced charting tools, high liquidity, and 24/7 customer support, Binance caters to both novice and expert traders. The exchange also provides educational resources via Binance Academy and innovative features like NFT marketplaces and savings options.

Bybit

High-performance crypto derivatives platform with robust tools and competitive trading conditions.

Bybit specializes in crypto derivatives, offering perpetual contracts and futures with up to 100x leverage. Its platform is designed for speed and reliability, featuring advanced order types, real-time market data, and a powerful matching engine.

With a focus on user security, Bybit employs cold storage and multi-signature wallets, alongside 24/7 multilingual support. Traders benefit from low fees, a testnet for practice, and regular trading competitions to enhance engagement and profitability.

Kraken

Secure and reliable crypto exchange with a focus on transparency and advanced trading options.

Kraken offers a robust platform for trading over 200 cryptocurrencies, including spot trading, margin trading, and futures with up to 50x leverage. Known for its strong security measures, it uses cold storage and two-factor authentication to protect user funds.

With competitive fees, detailed charting tools, and 24/7 global support, Kraken appeals to both beginners and seasoned traders. The exchange also provides educational content and staking options, making it a versatile choice for crypto enthusiasts.

Crypto.com

Comprehensive crypto ecosystem with trading, debit cards, and earning opportunities for users worldwide.

Crypto.com offers trading for over 250 cryptocurrencies, featuring spot trading, futures, and a user-friendly app. Its platform includes unique offerings like the Crypto.com Visa Card, allowing users to spend crypto with cashback rewards.

With low fees, high security through cold storage, and 24/7 customer support, Crypto.com caters to a broad audience. Additional features like staking, DeFi wallet integration, and educational resources make it a one-stop shop for crypto trading and investment.

Gemini

Regulated crypto exchange offering secure trading and custody solutions for beginners and institutions.

Gemini provides a secure platform for trading over 100 cryptocurrencies, with a strong emphasis on regulatory compliance. It offers spot trading, staking, and a robust custody service for institutional clients, alongside a user-friendly mobile app.

Known for its high security standards, including SOC 2 certification and cold storage, Gemini also provides educational resources via its Cryptopedia. With competitive fees and 24/7 support, it’s a trusted choice for safety-conscious crypto traders.

Bitget

Fast-growing crypto exchange with advanced derivatives trading and copy trading features.

Bitget offers a dynamic platform for trading over 200 cryptocurrencies, specializing in futures and perpetual contracts with up to 125x leverage. Its standout feature is copy trading, allowing users to replicate successful traders’ strategies.

With low fees, high-speed execution, and a secure infrastructure featuring cold storage, Bitget caters to both retail and advanced traders. The exchange provides 24/7 multilingual support and regular promotions, making it a competitive player in the crypto space.

KuCoin

Popular crypto exchange with a wide range of altcoins and innovative trading features.

KuCoin offers trading for over 700 cryptocurrencies, including a vast selection of altcoins and new tokens, with low fees starting at 0.1%. Its platform supports spot trading, futures, margin trading, and staking options for passive income.

With a user-friendly interface, advanced charting tools, and 24/7 customer support, KuCoin appeals to both beginners and seasoned traders. Features like KuCoin Shares (KCS) for fee discounts and a strong focus on emerging projects make it a favorite in the crypto community.

Coinbase

User-friendly crypto exchange with a focus on security and educational resources.

Coinbase supports trading for over 200 cryptocurrencies, including Bitcoin, Ethereum, and altcoins, with a simple interface for beginners and an advanced trading platform for pros. It offers staking, a crypto wallet, and low-fee spot trading.

Known for its regulatory compliance in the U.S. and robust security with cold storage, Coinbase provides learning rewards and 24/7 support. It’s perfect for those new to crypto or seeking a trusted, mainstream exchange.

Charles Schwab

Leading brokerage offering commission-free stock and ETF trading with robust research tools.

Charles Schwab provides access to thousands of stocks, ETFs, and mutual funds with zero-commission trading on many assets. Its platform, including the powerful Schwab Trading Powered by thinkorswim, offers advanced charting and extensive market research.

With a focus on investor education through webinars and detailed reports, plus 24/7 customer support, Schwab caters to both novice and experienced investors. Its strong regulatory standing and comprehensive financial services make it a top choice for long-term investing.

Interactive Brokers

Global brokerage with low-cost trading and advanced tools for sophisticated investors.

Interactive Brokers offers access to over 150 global markets, including stocks, ETFs, Forex, and CFDs, with some of the lowest fees in the industry. Its Trader Workstation (TWS) platform provides professional-grade tools, real-time data, and algorithmic trading capabilities.

Known for its extensive asset coverage and competitive margin rates, Interactive Brokers also offers robust educational resources and 24/7 support. It’s ideal for active traders and institutional clients seeking a versatile, high-performance trading environment.

tastytrade

Options-focused brokerage with low fees and an intuitive platform for active traders.

tastytrade specializes in options, stocks, and ETFs, offering low-cost trading with commissions as low as $1 per contract. Its platform is designed for active traders, featuring customizable charts, real-time data, and a unique options strategy builder.

With a strong emphasis on education through daily live shows and tutorials, plus 24/7 customer support, tastytrade appeals to traders looking to master options and futures. Its straightforward pricing and community-driven approach make it a standout choice.

Webull

Commission-free brokerage with advanced charting and crypto trading for modern investors.

Webull offers zero-commission trading on stocks, ETFs, and a selection of cryptocurrencies, with a sleek mobile and desktop platform. It provides advanced technical analysis tools, extended hours trading, and real-time market data for no additional cost.

With a focus on accessibility and education via its in-app learning center, Webull also offers 24/7 customer support. It’s a popular choice for cost-conscious traders seeking a blend of traditional and crypto markets in a user-friendly environment.

Robinhood

User-friendly brokerage with commission-free trading and a focus on accessibility for retail investors.

Robinhood pioneered commission-free trading for stocks, ETFs, and a selection of cryptocurrencies, making investing accessible through its intuitive mobile app. It offers fractional shares, extended hours trading, and a streamlined interface for beginners.

With educational resources, real-time market data, and 24/7 customer support, Robinhood appeals to new investors looking to start small. Its gamified approach and no-minimum account balance make it a favorite among younger traders entering the market.

E*TRADE

Established brokerage with powerful tools and commission-free trading for stocks and ETFs.

E*TRADE offers commission-free trading on stocks and ETFs, along with options and mutual funds, supported by its robust Power E*TRADE platform. It provides advanced charting, research tools, and portfolio analysis for traders of all levels.

With a strong focus on education through webinars and articles, plus 24/7 customer support, E*TRADE caters to both novice and experienced investors. Its integration with Morgan Stanley adds credibility and comprehensive financial services for long-term wealth building.

SoFi Active Invest

Modern brokerage with commission-free trading and a holistic financial services approach.

SoFi Active Invest offers commission-free trading on stocks, ETFs, and a limited selection of cryptocurrencies through its intuitive mobile and web platforms. It supports fractional shares and provides access to IPOs, appealing to new and growing investors.

With integrated financial planning tools, educational resources, and 24/7 customer support, SoFi caters to those seeking a seamless investing experience alongside other services like loans and banking. Its no-fee model and user-friendly design make it a strong contender.

Fidelity Investments

Trusted brokerage with robust research and commission-free trading for long-term investors.

Fidelity Investments provides commission-free trading on stocks, ETFs, and mutual funds, backed by its industry-leading research and Active Trader Pro platform. It offers advanced charting, portfolio management tools, and zero-expense-ratio index funds.

With extensive educational content, retirement planning resources, and 24/7 customer support, Fidelity appeals to both beginners and seasoned investors. Its long-standing reputation and comprehensive financial offerings make it a top pick for wealth-building strategies.

Trading 212

Commission-free platform with a wide range of assets and an easy-to-use interface for all traders.

Trading 212 offers commission-free trading on stocks, ETFs, Forex, and CFDs, with a user-friendly mobile and web platform. It provides fractional shares, real-time charts, and a practice account for beginners to test strategies risk-free.

With educational videos, a supportive community, and 24/7 customer support, Trading 212 appeals to both novice and experienced traders. Its transparent fee structure and broad asset selection make it a popular choice in the retail trading space.

Alpaca

API-driven brokerage with commission-free trading, tailored for developers and algorithmic traders.

Alpaca provides commission-free trading on stocks and ETFs, with a focus on API integration for automated trading strategies. Its platform offers real-time market data, unlimited paper trading, and a developer-friendly environment for building custom tools.

With robust documentation, community support, and 24/7 customer service, Alpaca caters to tech-savvy traders and developers. Its no-fee model and programmatic trading capabilities make it ideal for those leveraging algorithms in the stock market.

Firstrade

Commission-free brokerage offering a straightforward platform for stock and ETF trading.

Firstrade provides commission-free trading on stocks, ETFs, and options, with a simple, no-frills platform designed for cost-conscious investors. It offers real-time quotes, basic charting tools, and extended hours trading.

With educational resources and 24/7 customer support, Firstrade appeals to beginners and experienced traders alike. Its zero-commission model and no account minimums make it an accessible choice for building a diversified portfolio.

RoboMarkets

Versatile brokerage with competitive conditions across forex, CFDs, stocks, and ETFs.

RoboMarkets offers trading on forex, CFDs, stocks, and ETFs with tight spreads and high leverage options up to 1:500. Its platforms include MetaTrader 4, MetaTrader 5, and R StocksTrader, catering to diverse trading styles.

With fast execution, extensive educational content, and 24/7 multilingual support, RoboMarkets serves both retail and professional traders. Its robust infrastructure and variety of account types make it a strong option for multi-asset trading.

Top 25 Trading Brokers and Exchanges of 2025: A Comprehensive Guide

Below is a detailed exploration of the top 25 trading brokers and exchanges for 2025, focusing on their excellence in Forex, CFDs, Crypto, ETFs, and stocks. This guide is designed to provide accurate, professional insights for traders and investors, highlighting the key characteristics that define top-tier brokers in each category, the benefits of trading these instruments, and guidance on selecting the right partner for your financial journey.

In the fast-evolving world of online trading, choosing the right broker or exchange is a pivotal decision that can shape your financial success. The right platform ensures seamless execution, competitive pricing, and access to a diverse range of instruments, while a poor choice can lead to unnecessary costs, delays, or even security risks. As we look toward 2025, the trading landscape continues to advance with cutting-edge technology, stricter regulations, and a growing emphasis on transparency and trader empowerment.

1. Forex Trading: Navigating the Global Currency Markets

Overview of Forex Trading

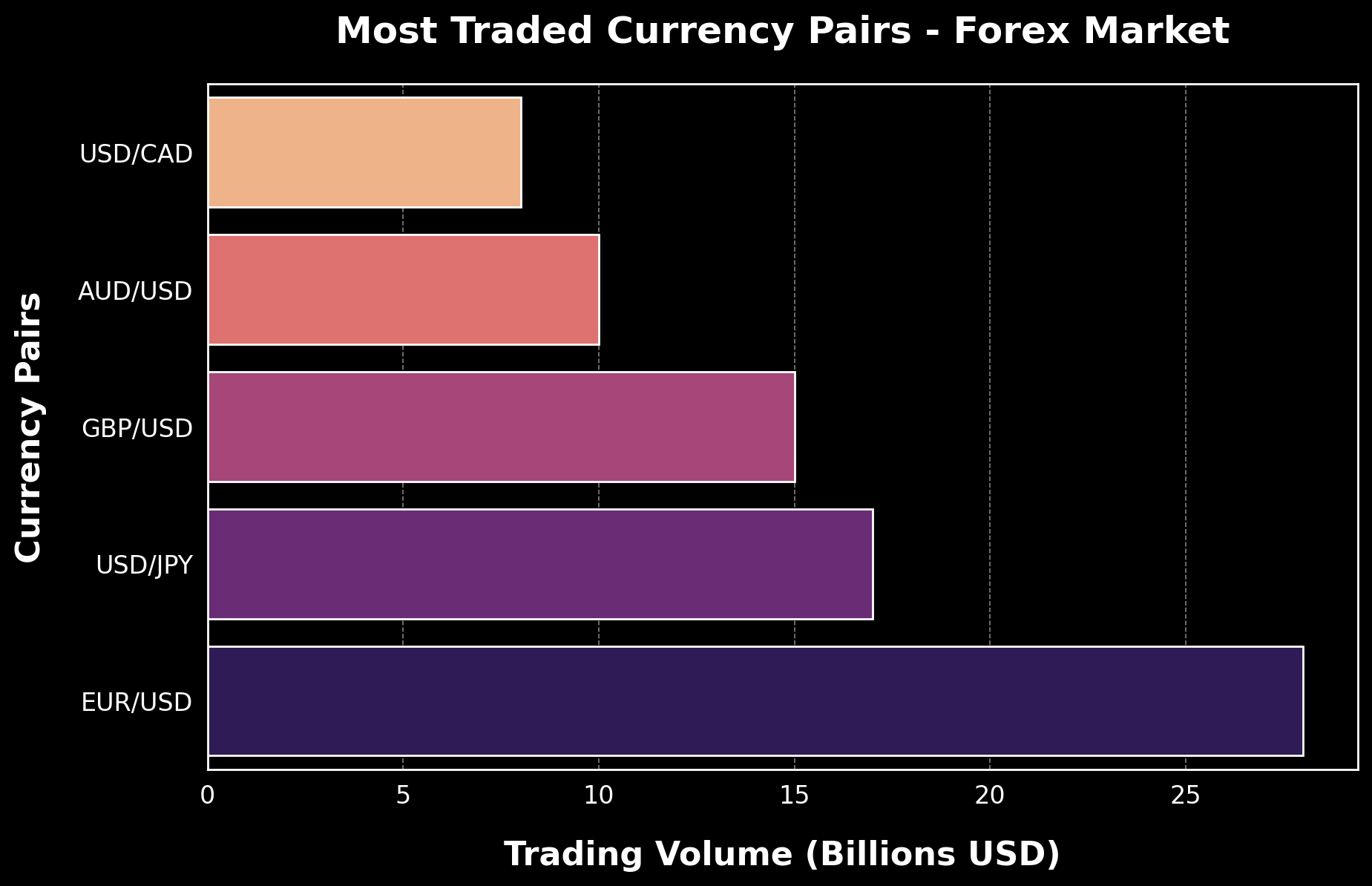

Forex, or foreign exchange, remains the world’s largest financial market, with a daily trading volume exceeding $7 trillion. It operates 24 hours a day, five days a week, allowing traders to buy and sell currency pairs—like EUR/USD, USD/JPY, or AUD/CAD—based on exchange rate fluctuations. Forex trading appeals to a wide range of participants, from institutional investors to retail traders, due to its accessibility, liquidity, and leverage opportunities.

Characteristics of Top Forex Brokers

The leading Forex brokers in 2025 stand out by offering:

- Extensive Currency Pair Selection: Access to over 50 pairs, including majors (e.g., EUR/USD), minors (e.g., GBP/CAD), and exotics (e.g., USD/TRY), catering to diverse strategies.

- Tight Spreads: Competitive spreads starting as low as 0.1 pips on major pairs, reducing trading costs.

- Advanced Trading Platforms: Intuitive platforms like MetaTrader 5, cTrader, or proprietary systems with real-time charting, technical indicators, and automated trading capabilities.

- High Liquidity: Partnerships with top-tier liquidity providers to ensure fast execution and minimal slippage.

- Flexible Leverage: Options ranging from 1:30 for retail traders (under strict regulations) to 1:500 for professional accounts, balancing risk and reward.

- Regulatory Assurance: Licensed by globally recognized authorities such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or Cyprus Securities and Exchange Commission (CySEC).

- Educational Tools: Free resources like webinars, tutorials, and market analysis to support trader development.

Why Trade Forex?

Forex trading offers distinct advantages:

- Round-the-Clock Access: Trade anytime from Sunday evening to Friday night, aligning with global time zones.

- Leverage Potential: Amplify returns with borrowed capital, though this increases risk exposure.

- Global Exposure: Profit from macroeconomic events, central bank policies, and geopolitical shifts.

2. CFDs: Speculating on Diverse Markets Without Ownership

Overview of CFD Trading

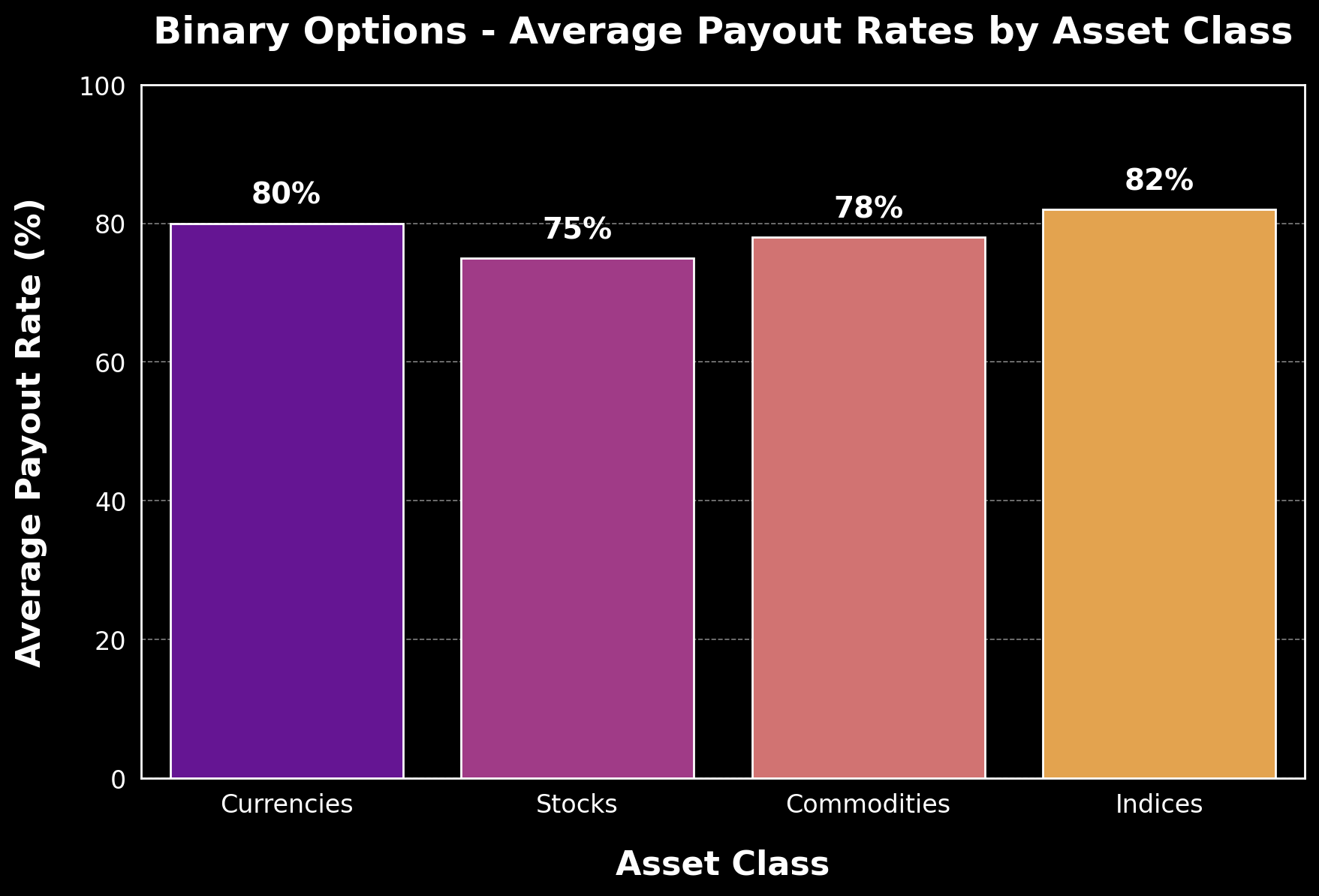

Contracts for Difference (CFDs) enable traders to speculate on price movements of various assets—such as commodities (gold, oil), indices (S&P 500, FTSE 100), shares, and cryptocurrencies—without owning the underlying instrument. CFDs are versatile, allowing traders to go long (buy) or short (sell), making them ideal for capitalizing on both bullish and bearish markets.

Characteristics of Top CFD Brokers

Elite CFD brokers in 2025 are defined by:

- Broad Asset Coverage: Hundreds of CFDs across Forex, stocks, indices, commodities, and cryptocurrencies, providing a one-stop trading hub.

- Competitive Leverage: Leverage up to 1:30 for retail clients and higher for professionals, tailored to risk profiles.

- Transparent Pricing: Low spreads and clear fee structures, with no hidden commissions or overnight swap costs undisclosed.

- Risk Management Features: Tools like stop-loss orders, take-profit levels, and negative balance protection to safeguard capital.

- Lightning-Fast Execution: Near-instant trade execution with minimal latency, critical for volatile markets.

- Mobile Trading: Fully functional apps for iOS and Android, ensuring traders can manage positions on the go.

- Regulatory Compliance: Oversight from regulators like the FCA, ASIC, or the Monetary Authority of Singapore (MAS) for security and trust.

Why Trade CFDs?

CFDs provide compelling benefits:

- No Asset Ownership: Trade price movements without the complexities of owning physical assets.

- Leverage Flexibility: Control larger positions with smaller capital, enhancing profit potential.

- Short-Selling Opportunities: Profit from falling prices, a feature unavailable in traditional stock trading.

- Market Variety: Access multiple asset classes through a single account.

3. Crypto: Trading the Future of Digital Assets

Overview of Crypto Trading

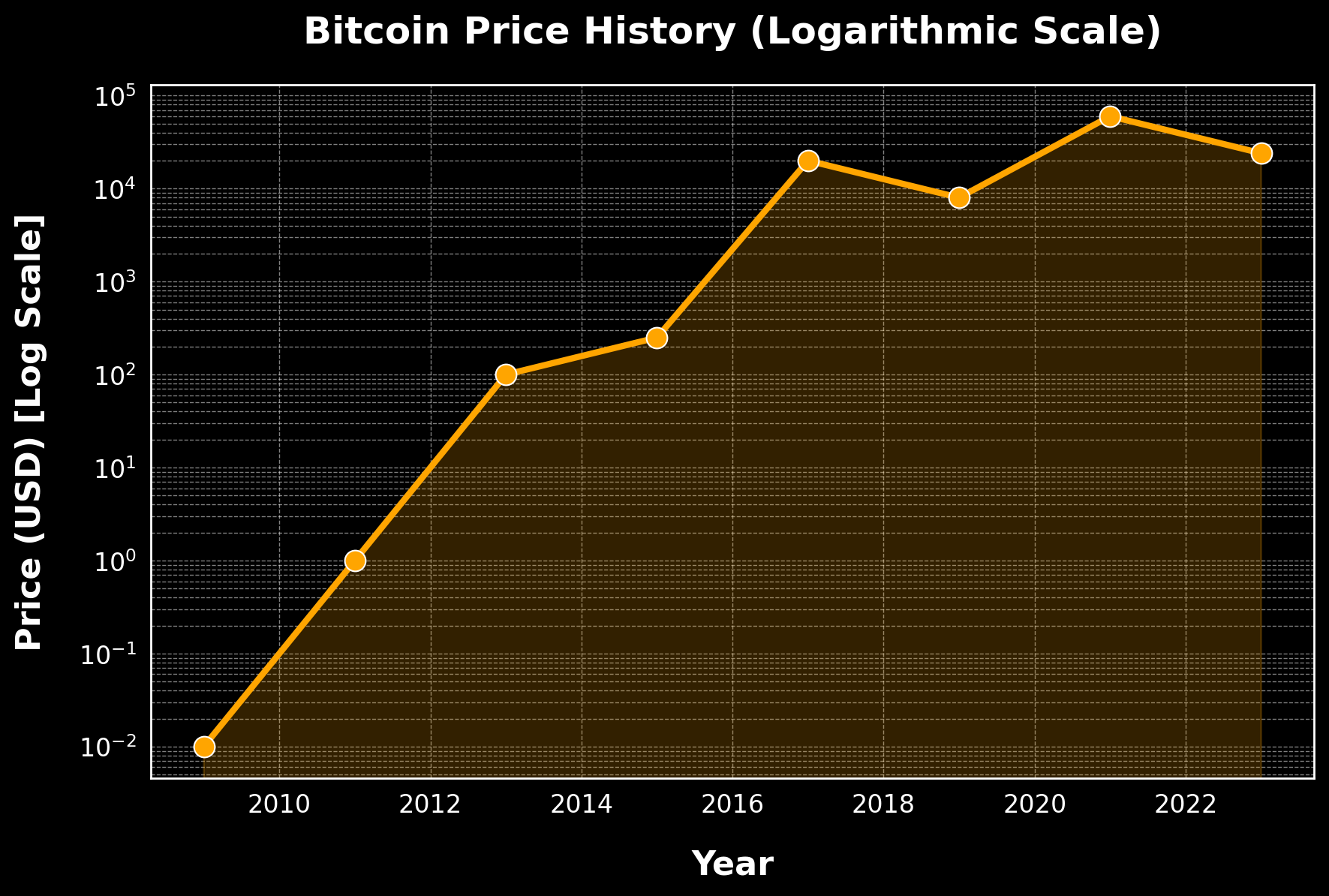

Cryptocurrency trading involves buying and selling digital assets like Bitcoin, Ethereum, and thousands of altcoins that operate on decentralized blockchain networks. Known for their volatility and innovation, cryptocurrencies have surged in popularity, offering traders opportunities for substantial gains in a rapidly evolving market that operates 24/7.

Characteristics of Top Crypto Brokers

The premier crypto brokers in 2025 are distinguished by:

- Wide Coin Selection: Access to major cryptocurrencies (e.g., BTC, ETH) and emerging tokens, often exceeding 100 options.

- Competitive Fees: Low trading fees, tight spreads, and transparent withdrawal costs, starting as low as 0.1% per trade.

- Secure Platforms: Advanced security features like two-factor authentication (2FA), cold storage, and encryption to protect assets.

- High Leverage: Up to 1:100 for professional traders, allowing amplified exposure to crypto price movements.

- Fast Execution: Near-instant order processing to capitalize on rapid market shifts.

- Regulatory Standards: Licensed by authorities like the FCA, ASIC, or U.S. Commodity Futures Trading Commission (CFTC) where applicable.

- Educational Resources: Guides on blockchain basics, market trends, and trading strategies to empower users.

Why Trade Crypto?

Crypto trading offers unique benefits:

- High Volatility: Significant price swings provide opportunities for substantial profits.

- 24/7 Availability: Trade anytime, anywhere, with no market closures.

- Decentralized Access: Participate in a global market without traditional intermediaries.

- Innovative Potential: Engage with cutting-edge blockchain technologies and emerging digital economies.

4. ETFs: Diversified Investment with Lower Risk

Overview of ETF Trading

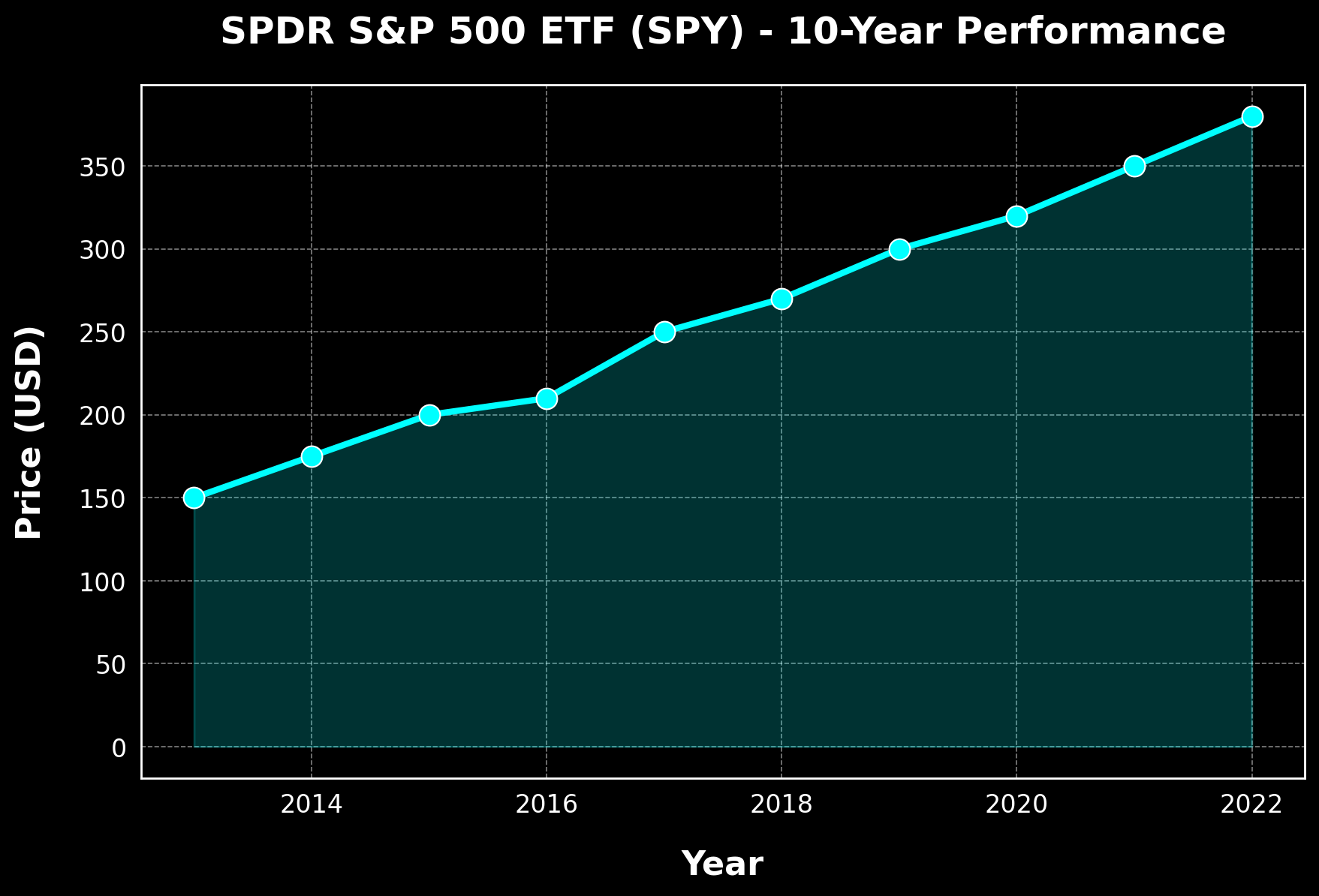

Exchange-Traded Funds (ETFs) are investment vehicles traded on stock exchanges, tracking a basket of assets like stocks, bonds, or commodities. ETFs combine the diversification of mutual funds with the flexibility of stocks, offering a cost-effective way to gain exposure to specific sectors, regions, or themes (e.g., technology, renewable energy).

Characteristics of Top ETF Brokers

The best ETF brokers in 2025 excel in:

- Extensive ETF Range: Hundreds of ETFs covering global markets, from large-cap equities to niche sectors like ESG (Environmental, Social, Governance) investments.

- Low-Cost Trading: Zero-commission trades on many ETFs, alongside low management fees.

- Sophisticated Tools: Screening tools to filter ETFs by performance, expense ratio, or sector, plus portfolio analysis features.

- Reliable Execution: High-speed order processing to capture optimal entry and exit points.

- Investor Resources: Detailed guides, market insights, and historical data to inform investment decisions.

- Regulatory Protection: Compliance with authorities like the U.S. Securities and Exchange Commission (SEC) or the European Securities and Markets Authority (ESMA).

Why Trade ETFs?

ETFs offer unique advantages:

- Diversification: Spread risk across multiple assets within a single trade.

- Cost Efficiency: Lower expense ratios compared to actively managed funds.

- Intraday Trading: Buy and sell throughout the trading day, unlike mutual funds.

- Transparency: Daily disclosure of holdings for full visibility.

5. Stocks: Direct Investment in Global Companies

Overview of Stock Trading

Stock trading involves buying and selling shares of publicly listed companies, granting ownership stakes and potential dividends. From blue-chip giants like Apple and Microsoft to emerging firms in developing markets, stocks remain a cornerstone of wealth-building strategies.

Characteristics of Top Stock Brokers

Leading stock brokers in 2025 are recognized for:

- Global Market Access: Trading on major exchanges like the NYSE, NASDAQ, London Stock Exchange (LSE), and emerging markets in Asia and Africa.

- Low Fees: Zero-commission stock trading, with minimal custody or inactivity fees.

- Powerful Platforms: Feature-rich interfaces with real-time quotes, advanced charting, and algorithmic trading options.

- Research Excellence: In-depth reports, earnings forecasts, and analyst recommendations to guide investment choices.

- Top-Notch Support: 24/7 customer service via live chat, phone, or email, with multilingual options.

- Security Standards: Funds protected under frameworks like the Financial Services Compensation Scheme (FSCS) or the Securities Investor Protection Corporation (SIPC).

Why Trade Stocks?

Stock trading provides:

- Ownership Benefits: Equity in companies, with potential dividends and voting rights.

- Growth Potential: Long-term capital appreciation as companies expand.

- Market-Driven Gains: Opportunities tied to corporate performance, sector trends, and economic cycles.

- Portfolio Flexibility: Build tailored portfolios across industries and geographies.

Conclusion: Choosing the Right Broker for Your Trading Journey

The top 25 brokers and exchanges of 2025 share a commitment to excellence, delivering cutting-edge technology, competitive conditions, and robust security for traders and investors. Whether your focus is Forex, CFDs, Crypto, ETFs, or stocks, the right broker enhances your ability to execute strategies effectively while protecting your capital.

When selecting a broker, prioritize these factors:

- Regulation: Verify licensing with reputable bodies like the FCA, ASIC, SEC, or ESMA to ensure fund safety.

- Trading Conditions: Assess spreads, leverage, commissions, and execution speeds for cost-effectiveness.

- Platform Quality: Opt for intuitive, reliable platforms with tools suited to your trading style.

- Customer Support: Choose brokers with responsive, knowledgeable teams available when you need them.

- Resources and Education: Leverage tutorials, market updates, and analytical tools to sharpen your skills.

By aligning your choice with your goals—whether short-term speculation or long-term investment—you can partner with a broker that empowers your success in the dynamic markets of 2025 and beyond.